ucheba-service.ru

Tools

Kin Crypto Price

The current price of KIN (KIN) is USD — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out what coins. Kin is a form of digital cryptocurrency, also referred to as KIN Coin. Use this page to follow the Kin price live, cryptocurrency news, Kin market cap and. The current Kin price is $ In the last 24 hours Kin price moved %. The current KIN to USD conversion rate is $ per KIN. The circulating. Kin fundamental analysis ; Project name. Kin ; Stock symbol. KIN ; Current price. ; Current supply. ; ROI since launch. -. The live Kin price today is $ USD with a hour trading volume of $ USD Historical Data. Products. Product Updates · CMC Labs · Crypto API. The Kin price today is $ USD with a 24 hour trading volume of $K USD. Kin (KIN) is down % in the last 24 hours. About. The live Kin price today is $ with a hour trading volume of $K. The table above accurately updates our KIN price in real time. The price of KIN. View Kin (KIN) cryptocurrency prices and market charts. Stay informed on how much Kin is worth and evaluate current and historical price information. Kin USD Price Today - discover how much 1 KIN is worth in USD with converter, price chart, market cap, trade volume, historical data and more. The current price of KIN (KIN) is USD — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out what coins. Kin is a form of digital cryptocurrency, also referred to as KIN Coin. Use this page to follow the Kin price live, cryptocurrency news, Kin market cap and. The current Kin price is $ In the last 24 hours Kin price moved %. The current KIN to USD conversion rate is $ per KIN. The circulating. Kin fundamental analysis ; Project name. Kin ; Stock symbol. KIN ; Current price. ; Current supply. ; ROI since launch. -. The live Kin price today is $ USD with a hour trading volume of $ USD Historical Data. Products. Product Updates · CMC Labs · Crypto API. The Kin price today is $ USD with a 24 hour trading volume of $K USD. Kin (KIN) is down % in the last 24 hours. About. The live Kin price today is $ with a hour trading volume of $K. The table above accurately updates our KIN price in real time. The price of KIN. View Kin (KIN) cryptocurrency prices and market charts. Stay informed on how much Kin is worth and evaluate current and historical price information. Kin USD Price Today - discover how much 1 KIN is worth in USD with converter, price chart, market cap, trade volume, historical data and more.

Additionally, KIN can reach a maximum price level of $ At the end of , Kin will have an average price of $ The crypto market expects a. The cryptocurrency is ranked with a market cap of $M. Over the last 24 hours, it saw $K of trading volume. The token has a circulating supply of. Kin is a cryptocurrency used for microtransactions in consumer apps. Millions of people are earning and spending Kin across an ecosystem of numerous apps. The live price of Kin is $ per KIN/USD, with a current market cap of $41,, USD. The hour trading volume is $, USD. The KIN to. The live price of Kin is $ per (KIN / USD) with a current market cap of $ M USD. hour trading volume is $ , USD. KIN to USD price is. Kin (KIN) is a cryptocurrency that allows users to earn Kin rewards by confirming blockchain transactions, which is known as mining. The current market. Kin (KIN) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. KIN Markets ; USDT price logo. KIN/ USDT · MEXC Global. $, $ K · %. $ % ; USDT price logo. KIN/ USDT · CoinEx. $ r/kin: Kin is an open, decentralized cryptocurrency with no inflation, no foundation, and no website. And because Kin runs on the Solana blockchain. The current Kin usd price is $ We update the Kin USD price in real time. Get live prices of Kin on different cryptocurrency exchanges around the. Kin price is $, down % in the last 24 hours, and the live market cap is $39,, It has circulating supply of 2,,,, KIN coins. 1 KIN equals USD. The current value of 1 Kin is +% against the exchange rate to USD in the last 24 hours. The current Kin market cap is. Easily convert Kin to US Dollar with our cryptocurrency converter. 1 KIN is currently worth $ Kin (KIN) is a cryptocurrency launched in Kin has a current supply of 2,,,, The last known price of Kin is USD and is up. Kin price today is $ with a hour trading volume of $ ,, market cap of $ M, and market dominance of %. The KIN price decreased The current Kin price is €. The price has changed by % in the past 24 hours on trading volume of €. The market rank of Kin is Coming to the price of Kin cryptocurrency, the value of the token peaked in the first week of January. It reached its high at levels slightly above the $ KIN Kin ; Kin. $ +% ; Use TokenInsight App All Crypto Insights Are In Your Hands. 22 August - The KIN price today is USD. View KIN-USD rate in real-time, live KIN chart, market cap and latest KIN News. What is the value of Kin coin? 1 Kin is worth $ How to use Kin coin in API? To get price and.

Putting Brick On Exterior Of House

You will pay an average of $15 per square foot to install brick siding on your house, with costs typically falling between $9 and $28 per square foot. For a. Painted Brick House Ideas Looking to give your brick home exterior an update? Consider adding a coat of paint. Many designers (including HGTV stars like Ben. We have been looking at new construction homes and a lot I am seeing are built with brick exteriors in the front, but the back is full siding and the sides of. Brick veneer siding is a way to reduce costs while retaining many of the aesthetic advantages of a brick exterior. I'm going to give you a little background to. How to do it: · Cover the exterior walls with a water-resistant house wrap or building paper to create the drainage plane. · Next, begin laying the brick in the. Adding exposed brick to your home is a great way to add character and charm, and there are lots of ways to do it. Taking a look at some great options. But since a brick veneer home uses a single non-structural layer of brick, the roof load is not exerted on the bricks, neither does the weight of the walls. Consider Length of Home Ownership Brick has many advantages. It is durable and won't rot, mold, mildew, melt, warp or get eaten by insects. Its upkeep is. You will pay an average of $15 per square foot to install brick siding on your house, with costs typically falling between $9 and $28 per square foot. For a. You will pay an average of $15 per square foot to install brick siding on your house, with costs typically falling between $9 and $28 per square foot. For a. Painted Brick House Ideas Looking to give your brick home exterior an update? Consider adding a coat of paint. Many designers (including HGTV stars like Ben. We have been looking at new construction homes and a lot I am seeing are built with brick exteriors in the front, but the back is full siding and the sides of. Brick veneer siding is a way to reduce costs while retaining many of the aesthetic advantages of a brick exterior. I'm going to give you a little background to. How to do it: · Cover the exterior walls with a water-resistant house wrap or building paper to create the drainage plane. · Next, begin laying the brick in the. Adding exposed brick to your home is a great way to add character and charm, and there are lots of ways to do it. Taking a look at some great options. But since a brick veneer home uses a single non-structural layer of brick, the roof load is not exerted on the bricks, neither does the weight of the walls. Consider Length of Home Ownership Brick has many advantages. It is durable and won't rot, mold, mildew, melt, warp or get eaten by insects. Its upkeep is. You will pay an average of $15 per square foot to install brick siding on your house, with costs typically falling between $9 and $28 per square foot. For a.

Painting your home's exterior brick is a quick solution for many homeowners wanting a change—but is it the best solution? Painted brick requires continued. This installation video demonstrates installing a thin brick veneer on an exterior application, such as a concrete front entry of a residential home. Siding is often a top contender for homeowners looking for ways to refresh their brick exterior or expand their home—and they are looking to builders like. Brick siding is a costly exterior design option, especially when Installing brick siding could significantly increase the market value of your home. No matter the type of house you own, the classic appeal of a brick exterior has withstood the test of time. Bricking a home will cost between $16, and. The brick supports itself for its gravity/weight load and is tied to the building for lateral support. It doesn't really “lean” on the building. Reface your home's old brick with new stacked stone siding. GenStone's faux stacked stone panels are affordable, lightweight and easy to install. The right paint for exterior brick is a mineral-based paint or a silicate paint that's designed to be breathable and recommended for brick, such as the brand. Brick homes are expensive but worth it as they offer lots of long-term advantages and can weather well, still they are not suitable for some. How to Install Stone Over Damaged Brick If your brick is crumbling, you won't be able to rely on its strength to hold mortar or stones. It can be expensive to. Bricks should be brick and not painted. Paint is for materials that need additional protection from weather. You should paint the other exterior. Cement siding over brick is one of the most durable materials and works well with brick; Can increase the property value and curbside appeal of the home; May. Yes, you can install brick on an existing home. One method Another option is to apply a brick veneer on your exterior walls after removing your siding. Brick houses are timeless. Made from clay and shale, bricks give a home a uniform look that complements almost every exterior home design. Not only is brick. This is a nice application for kitchens, fireplaces and accent walls. Exterior brick veneer is quite different – it's not installed on top of the house, but. 1- Clean your exterior walls · 2- Attach wire mesh · 3- Apply mortar to the wall · 4- Install brick siding corners · 5- Place the panels · 6- Grout. Brick siding can be applied to any home's exterior. Use brick masonry if you want to build a brick home from scratch. Most homes today with a brick exterior are. Installing thin brick veneer gives homes the same charm of full-faced brick with more style options and less time to install. Though thin brick works well for. A brick home does give your house great curb appeal. However, you don't have to be stuck with that option. While you might want to update the exterior of. Installing thin brick veneer gives homes the same charm of full-faced brick with more style options and less time to install. Though thin brick works well for.

Check Store Near Me

Find a Target store near you quickly with the Target Store Locator. Store hours, directions, addresses and phone numbers available for more than Target. Our Starbucks store locator will help you find locations near you where you can enjoy great beverages and wi-fi. Find a Starbucks now. Find a nearby store. Get the store hours, driving directions and services 44 stores near to your location , within 50 miles44 stores near to. Use this store locator to find your local grocery store. Find produce, pharmacy, fuel, and groceries near you with. About Vineland Supercenter. Looking for a one-stop shop for financial services? Whether you want to send money to a loved one or get some assistance with your. Find the Michaels store closest to you through the Michaels Store Locator. Best Buy Store Locator. Search by Postal Code or City and Province. City, State/Provice, Zip or City & Country. Submit a search. Geolocate. Store Locator – Check Into Cash Near Me. Map of the United States featuring Check Into Cash store locations across the nation. Find Payday Loans, Cash. Find the Michaels store closest to you through the Michaels Store Locator. Find a Target store near you quickly with the Target Store Locator. Store hours, directions, addresses and phone numbers available for more than Target. Our Starbucks store locator will help you find locations near you where you can enjoy great beverages and wi-fi. Find a Starbucks now. Find a nearby store. Get the store hours, driving directions and services 44 stores near to your location , within 50 miles44 stores near to. Use this store locator to find your local grocery store. Find produce, pharmacy, fuel, and groceries near you with. About Vineland Supercenter. Looking for a one-stop shop for financial services? Whether you want to send money to a loved one or get some assistance with your. Find the Michaels store closest to you through the Michaels Store Locator. Best Buy Store Locator. Search by Postal Code or City and Province. City, State/Provice, Zip or City & Country. Submit a search. Geolocate. Store Locator – Check Into Cash Near Me. Map of the United States featuring Check Into Cash store locations across the nation. Find Payday Loans, Cash. Find the Michaels store closest to you through the Michaels Store Locator.

Finding a check cashing grocery store in New York is straightforward. Search for “check cashing grocery stores near me” using your preferred search engine or. Find a 7-Eleven convenience store in your area with our store locator. Visit a 7-Eleven near you for food, snacks, drinks, fuel, coffee and more. Want the latest phones? Need a new wireless data plan? Get directions, store hours, and phone number for an AT&T store near you Check availability · AT&T. So stop in today to see why Your Exchange Money Center is your one-stop shop for all your financial services needs. FIND A STORE NEAR ME. Find a Winners store near you with our store locator tool. Find all locations with hours, directions, and contact info. Check out our Fab Finds today! Use our simple store locator to find your nearest Money Services Desk, so you can pay bills, cash checks and send money at one convenient location. and Conditions. Close. Close. Need help planning your trip? Be sure to check out What's New for the lowdown on the latest products to add to your Shopping List! Get the store hours, driving directions and services available at a Walmart near you. Search. Use my current. Please select your state to get the most accurate information about the products and services we offer near you. Press RoomCareers About Us · Facebook. DG Me · Literacy Foundation · Newsroom · Real Estate · Alternative Dispute Change to new store. Close sezzle-image. Check out with DG Buy Now Pay Later. Find an Apple Store and shop for Mac, iPhone, iPad, Apple Watch and more. Sign up for Today at Apple programs. Or get support at the Genius Bar. Find a Target store near you quickly with the Target Store Locator. Store hours, directions, addresses and phone numbers available for more than Target. Store & Photo; Closes soon at 9pm. Pharmacy. Village Medical Primary Care Clinics *; Open until 5am. Pickup & delivery available. Use the Best Buy store locator to find stores in your area. Then, visit each Best Buy store's page to see store hours, directions, news, events and more. Amazon pickup is now available at select Ross Stores. Check the Store Locator for availability near you. Cash a Check. Apply for a Cash Advance Loan online. Send and Receive Money via Western Union. All Over Florida. Find a Verizon store near you to learn more about our latest cell phone deals and plans or our high-speed internet, cable TV, & phone services. Use our store locator to find a Circle K convenience store near you. Visit us today for a wide variety of food, drinks, snacks, and more on the go. Find a The UPS Store location near you today. The UPS Store franchise locations can help with all your shipping needs. Contact a location near you for. We have expanded to over stores across seven states. Every year we are opening up more locations. Find a store near you!

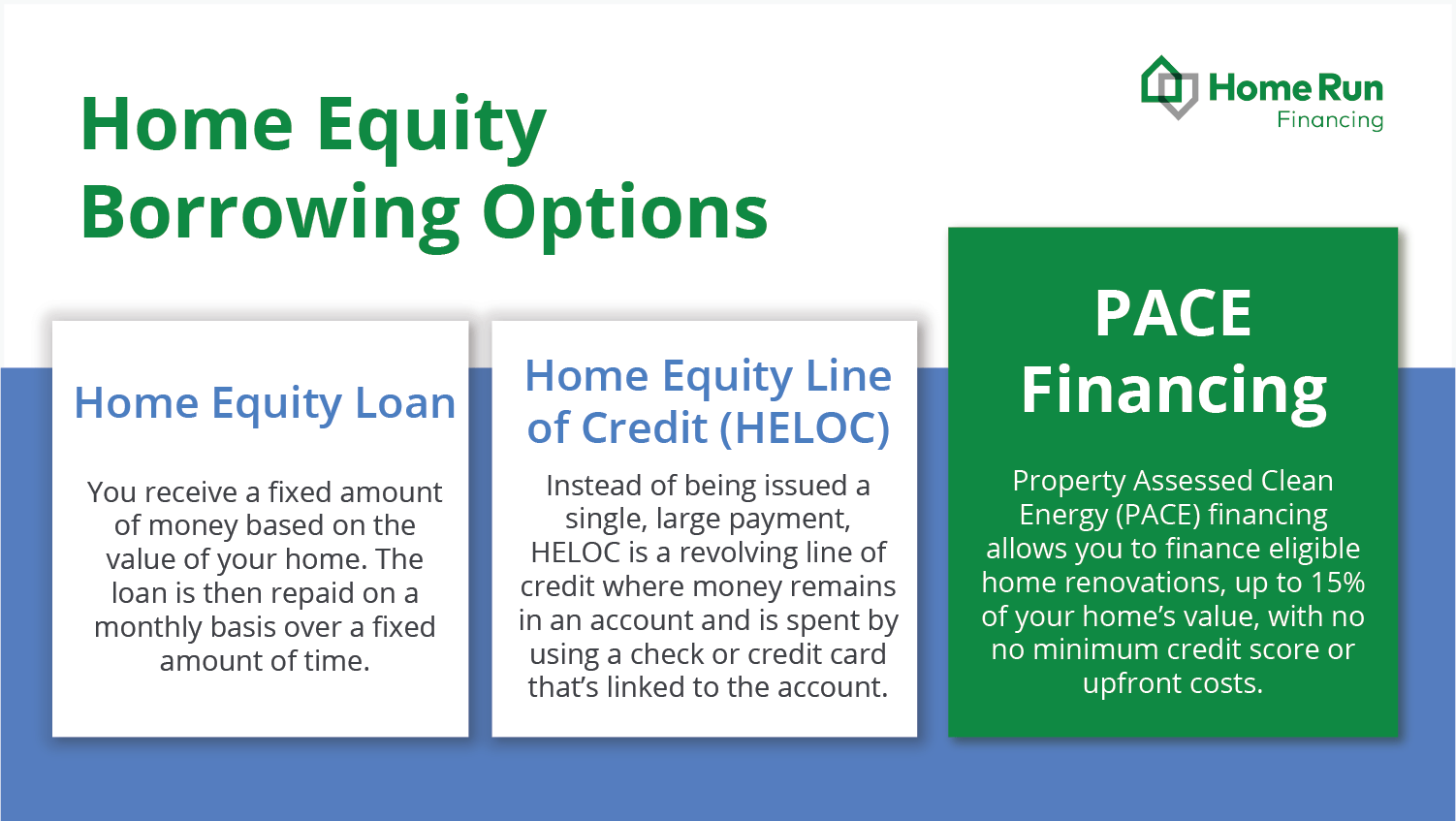

When To Use Home Equity

Please remember to use the equity from your house you have to borrow against your house. That means another house payment on top of your current. Cash-out refinance. A cash-out refinance allows you to use your home's equity to borrow for a larger amount than your original mortgage. You can use that extra. This guide describes how you might be able to use your home equity should the need arise— Similar to a home equity loan, a home equity line of credit. Find out how to pull equity out of your home with a HELOC (home equity line of credit) or HELOAN (home equity loan). Find the right loan for you at WaFd. Using the formula from above (home value) – (principal owed) = (home equity) you would have $, in equity. Building equity through your monthly. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large. Cash-out refinance. Access equity in your home by refinancing your existing mortgage and rolling it into a new, larger loan. At closing, your lender will issue. When facing a major expense, some homeowners may use a home equity loan or a home equity line of credit (HELOC) to borrow money against the equity in their home. However, it's ideal to have an emergency fund with at least three to six months of living expense. Please remember to use the equity from your house you have to borrow against your house. That means another house payment on top of your current. Cash-out refinance. A cash-out refinance allows you to use your home's equity to borrow for a larger amount than your original mortgage. You can use that extra. This guide describes how you might be able to use your home equity should the need arise— Similar to a home equity loan, a home equity line of credit. Find out how to pull equity out of your home with a HELOC (home equity line of credit) or HELOAN (home equity loan). Find the right loan for you at WaFd. Using the formula from above (home value) – (principal owed) = (home equity) you would have $, in equity. Building equity through your monthly. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large. Cash-out refinance. Access equity in your home by refinancing your existing mortgage and rolling it into a new, larger loan. At closing, your lender will issue. When facing a major expense, some homeowners may use a home equity loan or a home equity line of credit (HELOC) to borrow money against the equity in their home. However, it's ideal to have an emergency fund with at least three to six months of living expense.

A second home can be an excellent investment in many cases, and your existing home may be your only source of significant funding for such a purchase. A home. How does a home equity loan work? A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in. Loan providers offer the maximum loan amount of up to 80% or 85% on your home equity. So, if your home's market value has increased or you are left with a. Depending on how much equity you have, you can take cash out and use it to consolidate high-interest debt, pay for home improvements, or pay for college. How Do. As a rule of thumb, equity loans are generally made for up to 80% of your home's equity, and your credit score and income are also considered for qualification. Once you've gained equity in your home, you can use home equity by taking out a Fixed-Rate Equity Loan or Home Equity Line of Credit (HELOC), which borrows. Typically, you will need a score of or better and no more than 45% in debt to income. A home equity line of credit, also known as a HELOC, is a revolving. Home equity refers to the portion of your home that you own outright, versus the portion you still owe to the mortgage lender. To find out how much equity you. A home equity line of credit (HELOC) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral. Typically, you can. While there are many ways to tap home equity, a home equity agreement (HEA) from Unlock is unique because it was designed to help families solve their financial. Depending on your equity stake in your property, a home equity loan allows you to free up a large amount of cash at one time to cover major life expenses. The. How can you use home equity? · Fund projects, repairs, or pay for large purchases. · Consolidate what you owe on credit cards or other higher-rate debts into a. What can I use a home equity loan for? · Completing home renovations and energy-efficient upgrades · Debt consolidation to clear out high-interest-rate credit. Home equity is the dollar portion of the home that you own based on how much you owe on your mortgage, as well as any other secured loans that use the home as. You can estimate your home's equity by taking the current fair market value of your home and subtracting your current mortgage balance, plus the balance of any. A home equity loan is a mortgage that sits on top of your current first mortgage as a completely separate loan. It lets you use the remaining. Also known as a “second mortgage,” a home equity loan allows you to borrow money using the equity in your home as collateral. Equity is the amount your property. A home equity loan provides a one-time, lump-sum disbursement to qualified borrowers. How much you can borrow depends on your loan-to-value (LTV) ratio. LTV is. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home.

Tax Exchange

Learn About Tax Deferred Exchanges. In most cases, any real property can be part of a tax deferred exchange provided it is held for business or investment. A exchange allows you to defer paying taxes on the sale of an investment property if you use the proceeds to purchase another investment property. This. There can be both deferred and recognized gain in the same transaction when a taxpayer exchanges for like-kind property of lesser value. This fact sheet, the. If you own investment property and are thinking about selling it and buying another property, you should know about the tax-deferred exchange. Third, Section tax deferred exchanges allow real estate investors who sell a like-kind property and replace it with another piece of real estate to defer. § ), a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process. An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to. III. INTERNAL REVENUE CODE SECTION A. No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or. A exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. It's important to keep in mind. Learn About Tax Deferred Exchanges. In most cases, any real property can be part of a tax deferred exchange provided it is held for business or investment. A exchange allows you to defer paying taxes on the sale of an investment property if you use the proceeds to purchase another investment property. This. There can be both deferred and recognized gain in the same transaction when a taxpayer exchanges for like-kind property of lesser value. This fact sheet, the. If you own investment property and are thinking about selling it and buying another property, you should know about the tax-deferred exchange. Third, Section tax deferred exchanges allow real estate investors who sell a like-kind property and replace it with another piece of real estate to defer. § ), a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process. An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to. III. INTERNAL REVENUE CODE SECTION A. No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or. A exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. It's important to keep in mind.

Key Takeaways · A Exchange is an exchange of like-kind properties that are held for business or investment purposes in the United States. · The exchange. California generally conforms to Internal Revenue Code (IRC) section as revised by the Tax Cuts and Jobs Act of (TCJA) for exchanges initiated after. Holland & Knight's tax attorneys have significant experience handling "like-kind exchange" or " exchange" transactions. Holland & Knight's tax attorneys have significant experience handling "like-kind exchange" or " exchange" transactions. exchange (also called a tax-deferred exchange or a Starker exchange) refers to the ability of investors and organizations to replace one investment for. A exchange is the swap of one investment property for another in order to defer capital gains taxes until a later date. The Tax-Deferred Exchange Process: How to Start & What to Expect. The Basics. Section of the Internal Revenue Code of , as amended, permits a. The tax deferred exchange, as defined in § of the Internal Revenue Code, offers taxpayers one of the last great opportunities to build wealth and defer. What You Need to Know About Exchanges. The Exchange name comes from Internal Revenue Code Section It enables you to defer capital gains tax. How do Exchanges work? In real estate, a exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. A. The most common Exchange structure is a Forward, or Delayed, Exchange where you sell your relinquished property first and then acquire your. Eligibility for Exchanges. Section of the tax code allows property owners to defer taxes on the sale of their real estate held for business or. Tax Information Exchange Agreements (TIEAs). A tax information exchange agreement (TIEA) allows the competent authorities of the United States and the TIEA. taxes. In these cases, you should consider whether you want to take advantage of a tax-deferred exchange. This exchange practice outlined in Internal. For active real estate investors, performing exchanges on properties they're selling and buying allows them to defer paying capital gains tax and/or. Property held for productive use in a trade or business or for investment qualifies for a Exchange. The tax code specifically excludes some property even. What is a Exchange? A Exchange is a transaction approved by the IRS allowing real estate investors to defer the tax liability on the sale of. The taxpayer(s) that own the property must be US taxpayers, but not necessarily US citizens. The Tax Cuts and Jobs Act restricted Section to apply. the due date (determined with regard to extension) for the transferor's return of the tax imposed by this chapter for the taxable year in which the transfer of. A Exchange allows you to defer paying capital gains tax on the sale of a property by reinvesting the proceeds in other real estate. Learn more today.

How Much Is Homeowners Insurance On 250 000 Home

Your home insurance cost will also depend on how much coverage you need. Homeowners in California requiring $, in dwelling coverage will pay an average of. This may have nothing to do with the purchase price or the current market value of your home, as homeowners insurance does not generally cover the value of the. Home Insurance Calculator with NO personal information needed. Use our two-step home insurance calculator and get an estimated annual cost of insurance for. Home Purchase Price Click for Home Purchase Price Info. $ Homeowners Insurance Click for Homeowners Insurance Info. The national average cost of home insurance is $2, per year for a policy with a $, dwelling limit. This evens out to about $ per month. But these. Let's say you buy a home for $, and you put $25, down. Lenders will require you to have at least $, in dwelling coverage. However, we always. Nationally, the average homeowner's insurance rate is $1, annually —which averages to $ monthly — for a home valued at $, This number could. Determine how much home insurance coverage you need by first understanding the difference between estimated replacement cost and market value. Home insurance rates average $2, per year for a policy with $, in dwelling coverage, $, in personal property coverage and $, in personal. Your home insurance cost will also depend on how much coverage you need. Homeowners in California requiring $, in dwelling coverage will pay an average of. This may have nothing to do with the purchase price or the current market value of your home, as homeowners insurance does not generally cover the value of the. Home Insurance Calculator with NO personal information needed. Use our two-step home insurance calculator and get an estimated annual cost of insurance for. Home Purchase Price Click for Home Purchase Price Info. $ Homeowners Insurance Click for Homeowners Insurance Info. The national average cost of home insurance is $2, per year for a policy with a $, dwelling limit. This evens out to about $ per month. But these. Let's say you buy a home for $, and you put $25, down. Lenders will require you to have at least $, in dwelling coverage. However, we always. Nationally, the average homeowner's insurance rate is $1, annually —which averages to $ monthly — for a home valued at $, This number could. Determine how much home insurance coverage you need by first understanding the difference between estimated replacement cost and market value. Home insurance rates average $2, per year for a policy with $, in dwelling coverage, $, in personal property coverage and $, in personal.

Get a personal property value estimate. Whether you live in a home, apartment, or condo, personal property coverage is one of the most important aspects of. Mortgage amount · Term in years · Interest rate · Monthly payment (PI) · Monthly payment (PITI) · Annual property taxes · Annual home insurance · Total payments. house with a replacement cost of $,, and his insurance coverage totals $, An unanticipated flood causes $, worth of damage to James' house. As an example, for a $, home, a down payment of % is $8,, while 20% is $50, Closing Costs. It is important to remember that a down payment only. The national average cost of home insurance is $2, per year for a policy with a $, dwelling limit. This evens out to about $ per month. But these. Home insurance protects your property and personal possessions. Our home insurance calculator can help you to determine how much coverage you need. Homeowners. You may purchase flood insurance covering up to $, of flood damage to your home. A standard flood policy will cover structural damage. As an example, I pay $ a month for property insurance, pay it yearly ($) but that is the monthly cost. My house is sq ft, built in. home is worth $,, you'll only be taxed on $, Check with your How much you'll pay for your homeowners insurance depends on many factors. Monthly housing expenses. Monthly outlay that includes monthly mortgage payment plus additional costs like property taxes and homeowners insurance, as well as. Some of the more common searches online for the average cost of home insurance include: How much is homeowner's insurance on a , house? How much is. Your homeowners insurance premiums are also tied to how much coverage you purchase. If you're buying an insurance policy to cover a home that's worth $, Depending on the interest rate, you can expect the monthly payment for a year loan to range from $1, to $1, Before you take out a $, You can reduce mortgage insurance costs by putting more money down. Show If you pay less than a 20% down payment on your home, you will have to pay PMI. Property & Home Insurance · Reverse Mortgages · Home · Help Topics · Mortgages the insurable value of the structure (typically the replacement cost value of. home price saved before applying for a mortgage. Being able to make a When you borrow money to buy a home, your lender requires you to have homeowners. How much does homeowners insurance cost? The amount you pay for home insurance depends on many factors. $, on the building and $, on contents. property will cost less than one that covers a $, worth of property. home knowing the potential impact on the cost of insurance. Still, there are. To get a better sense of the total costs of buying a home, use our home mortgage calculator and figure out what your future mortgage payments might be. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule.

How Much Does Pip Insurance Cost

But, generally speaking, PIP insurance costs between $50 and $ per year. Remember, though, that this is just the insurance cost itself. Your actual PIP. PIP coverage pays 80 percent of medical bills incurred because of the crash up to the policy limit. It pays 60 percent of lost wages if the injured individual. PIP is typically offered in amounts of $2,; $5,; and $10, It can be offered above $10,, but this is rare. These amounts are total per person. For. PIP – is often called no-fault insurance because covered claims are paid regardless of who's at fault in an accident. What does PIP cover? If you're in an. An average 45% or greater reduction per vehicle for the $50, PIP option · An average 35% or greater reduction per vehicle for the $, PIP option · An. How much does PIP cost in Michigan? The cost of PIP in Michigan, which is approximately 35% of your total auto insurance bill, depends on: (1) the level of. How much does PIP cover? · Medical and hospital expenses: Up to $10, for reasonable and necessary medical and hospital expenses for each person injured in an. PIP. How Much Does PIP or No-Fault Insurance Cost? The actual cost of PIP is something determined between you and your car insurance provider, which. Insurance Coverage Personal Injury Protection “How much PIP coverage should I get? is forbidden from increasing your insurance rates after filing a PIP. But, generally speaking, PIP insurance costs between $50 and $ per year. Remember, though, that this is just the insurance cost itself. Your actual PIP. PIP coverage pays 80 percent of medical bills incurred because of the crash up to the policy limit. It pays 60 percent of lost wages if the injured individual. PIP is typically offered in amounts of $2,; $5,; and $10, It can be offered above $10,, but this is rare. These amounts are total per person. For. PIP – is often called no-fault insurance because covered claims are paid regardless of who's at fault in an accident. What does PIP cover? If you're in an. An average 45% or greater reduction per vehicle for the $50, PIP option · An average 35% or greater reduction per vehicle for the $, PIP option · An. How much does PIP cost in Michigan? The cost of PIP in Michigan, which is approximately 35% of your total auto insurance bill, depends on: (1) the level of. How much does PIP cover? · Medical and hospital expenses: Up to $10, for reasonable and necessary medical and hospital expenses for each person injured in an. PIP. How Much Does PIP or No-Fault Insurance Cost? The actual cost of PIP is something determined between you and your car insurance provider, which. Insurance Coverage Personal Injury Protection “How much PIP coverage should I get? is forbidden from increasing your insurance rates after filing a PIP.

Insurance Law) is sustained. No-Fault is a personal injury coverage and does not pay for auto body repair of your car or damage to any other party's motor. On average, PIP coverage can add anywhere from $50 to $ or more to your annual auto insurance premium, depending on the factors mentioned above. However, the. The cost for PIP varies based on your state, driving history, and the coverage limits and deductibles you choose. As a reference, PIP typically averages %. Average PIP insurance costs The cost of PIP insurance depends on factors such as coverage level, age, type of vehicle, your auto insurance company, and. An average 45% or greater reduction per vehicle for the $50, PIP option · An average 35% or greater reduction per vehicle for the $, PIP option · An. On average, one Personal Injury Protection (PIP) claim will raise your car insurance premium $4 per year. Deductible: Your deductible is a flat cost that is always your responsibility to meet before the insurance company even begins to pay the bills. How much you. PIP is an add-on to your car insurance policy that will cover your immediate medical costs after an auto accident, whether or not you're at fault. If you don't have life insurance, PIP may pay for funeral costs and other expenses if your auto accident is fatal. Even if you have health insurance, most plans. The total cost of PIP insurance varies depending on which state you reside, your coverage limits, any deductibles, which company you select, and how many cars. PIP insurance is no-fault coverage, meaning you are entitled to the benefits regardless of who caused the auto accident. PIP benefits cover the policyholder. If you don't have health insurance, PIP may be an affordable way to cover your medical expenses and rehab costs resulting from an auto accident. And if you don'. Get An Insurance Quote. Dark Mode. Español · Back. Insurance. Vehicle Insurance How much PIP coverage should you get? Each person is different, and some. The total cost of PIP insurance varies depending on which state you reside, your coverage limits, any deductibles, which company you select, and how many cars. As with any insurance, the costs of personal injury protection coverage will vary according to a number of factors. These include where you live, your driving. Personal injury protection (PIP), which is also called “no-fault insurance,” covers medical bills and related costs resulting from an accident, no matter who. A: While PIP benefits generally do not impact insurance premiums, there may be some specific circumstances where they could indirectly influence insurance costs. How much does PIP cost in Michigan? The cost of PIP in Michigan, which is approximately 35% of your total auto insurance bill, depends on: (1) the level of. It is sometimes called “no-fault” coverage because it pays your own medical costs no matter who caused the accident. PIP has two parts – (1) Medical expense. In Texas, every driver must be offered at least $2, of PIP insurance, but additional coverage of $5, or $10, is available if you want more financial.

How Did Jesus Die The Second Time

second time (at least). Faith required that they transform suffering Israel Surely Jesus did not die in vain. God must have had some purpose for. In this resurrection, those who have died in Christ will have their redeemed souls and spirits united with a body similar to Christ's glorified body. Christians. Answer: Jesus died only once. Scripture reminds us that Jesus died “once for all” (Heb. ; ). Some people misunderstand the Sacrifice of the Mass. The first Adam brought death by a tree, but the second Adam brought life through His death on one. The Messiah, the Seed of the woman, would be the second Adam. Why Did Jesus Have to Die on the Cross? · 1. We Were Dead in Our Sins () · 2. We Were Deceived by Satan () · 3. We Were Disobedient to God () · 4. We Were. Brother Bob: It's not merely then just the ending of our biological existence, the ending for our breathing, but the Bible mentions a second time not violate. Christians believe that after Jesus rose from the dead, he did not die a second time. Instead, 40 days after his resurrection. When Did Jesus Die? Time, Day, and Year of His Crucifixion · Times of the Crucifixion in the Gospels · 1. The temple curtain was torn in two. · 2. An earthquake. The second death is not only executed by FIRE, after the thousand years, but was also executed by THE CRUCIFIXION of Christ. It is also executed in the. second time (at least). Faith required that they transform suffering Israel Surely Jesus did not die in vain. God must have had some purpose for. In this resurrection, those who have died in Christ will have their redeemed souls and spirits united with a body similar to Christ's glorified body. Christians. Answer: Jesus died only once. Scripture reminds us that Jesus died “once for all” (Heb. ; ). Some people misunderstand the Sacrifice of the Mass. The first Adam brought death by a tree, but the second Adam brought life through His death on one. The Messiah, the Seed of the woman, would be the second Adam. Why Did Jesus Have to Die on the Cross? · 1. We Were Dead in Our Sins () · 2. We Were Deceived by Satan () · 3. We Were Disobedient to God () · 4. We Were. Brother Bob: It's not merely then just the ending of our biological existence, the ending for our breathing, but the Bible mentions a second time not violate. Christians believe that after Jesus rose from the dead, he did not die a second time. Instead, 40 days after his resurrection. When Did Jesus Die? Time, Day, and Year of His Crucifixion · Times of the Crucifixion in the Gospels · 1. The temple curtain was torn in two. · 2. An earthquake. The second death is not only executed by FIRE, after the thousand years, but was also executed by THE CRUCIFIXION of Christ. It is also executed in the.

Questions about Jesus' death · When did Jesus die? · Jesus died at “the ninth hour” from sunrise, or at about three o'clock in the afternoon of the Jewish. The gospels record that Jesus raised three people who had died physical deaths back to life. 1. Jairus' daughter - Mark 9 2. Widow of Nain's son - Luke 7 3. The earth shook, the rocks split apart, the graves broke open, and many of God's people who had died were raised to life. When the soldiers saw the earthquake. John adds an editorial note to those words: "But He was saying this to indicate the kind of death by which He was to die" (v. 33). In other words, our Lord was. Jesus only died once. That was at His crucifixion, which he planned from the time before He was born to a spotless virgin. He knew the only way. So Christ, having been offered once to bear the sins of many, will appear a second time, not to deal with sin but to save those who are eagerly waiting for him. Put together, diving headlong into this debate for the first time can be overwhelming. In the second passage, the Apostle Peter gives his readers a. Second, the Hebrew calendar requires that the Barley crop is ready for Jesus died at the ninth hour. He also alleges that Humphreys uses two very. “Here's the Lord Jesus, who had always been in the bosom of the Father from eternity. Now He's separated from God the Father. He cries from that cross, 'My God. And then he died the painful death our sins deserve. John says, “God did not send the Son into the world to condemn the world, but in order that the world. The resurrection of Jesus is the Christian belief that God raised Jesus from the dead on the third day after his crucifixion, starting – or restoring – his. Given the prolonged agony of crucifixion, Jesus died later that afternoon at about the ninth hour (3 p.m.) (, Matthew , Luke ). "Excruciating,". die until when Jesus comes back for the second time. That is not true! We have actually always been told that there is a man whom Jesus told he would not. Historians and theologians agree that Jesus was approximately thirty-three years old at the time of His crucifixion. These facts are supported by outside. Did Jesus Die for Christians Only? Share. Listen to the audio version of When Did Jesus Die the Second Time? qa · Why Did God Have Jesus Die for Our. You can customize your settings at any time by going to Privacy Settings. II, page b See The Expanded Vine's Expository Dictionary of New Testament. According to the first view, known as general redemption, or unlimited atonement, Jesus died to make atonement for everyone, but his death was not effectual. Scripture testifies to the fact that Jesus died on a cross after being betrayed to the religious rulers by one of His own disciples, Judas Iscariot. The Bible says that Jesus was placed on the cross at 9 a.m. and darkness covered the land from noon until Jesus' death at 3 p.m. (Mark , ). Earlier in. before the 7-day Feast of Unleavened Bread on Nisan , also called Passover Week at the time. That is how Jesus both ate the Passover with his disciples one.

Dow Jones Industrial Average Daily Chart

DJIA | A complete Dow Jones Industrial Average index overview by MarketWatch. View stock market news, stock market data and trading information. Dow Jones Industrial Average - Present · Dow Jones Transportation Average - Present · Dow Jones Utility Average - Present · S&P Large Cap Index. Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges. Dow Jones” or simply “the Dow,” is one of the most popular and widely recognized stock market indices. It measures the daily stock market movements of Dow Jones Industrial Average · Price (USD)39, · Today's Change / % · Shares tradedm · 1 Year change+% · 52 week range32, - 41, Historically it's one of oldest and most followed indices. The chart is a useful measure of US economic health. Follow the Dow Jones live with the real-time. Dow Jones - 10 Year Daily Chart. Interactive chart illustrating the performance of the Dow Jones Industrial Average (DJIA) market index over the last ten years. Customizable interactive chart for Dow Jones Industrials Average with latest real-time price quote, charts, latest news, technical analysis and opinions. Here you will find a real-time chart of the Dow Jones. DJIA | A complete Dow Jones Industrial Average index overview by MarketWatch. View stock market news, stock market data and trading information. Dow Jones Industrial Average - Present · Dow Jones Transportation Average - Present · Dow Jones Utility Average - Present · S&P Large Cap Index. Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges. Dow Jones” or simply “the Dow,” is one of the most popular and widely recognized stock market indices. It measures the daily stock market movements of Dow Jones Industrial Average · Price (USD)39, · Today's Change / % · Shares tradedm · 1 Year change+% · 52 week range32, - 41, Historically it's one of oldest and most followed indices. The chart is a useful measure of US economic health. Follow the Dow Jones live with the real-time. Dow Jones - 10 Year Daily Chart. Interactive chart illustrating the performance of the Dow Jones Industrial Average (DJIA) market index over the last ten years. Customizable interactive chart for Dow Jones Industrials Average with latest real-time price quote, charts, latest news, technical analysis and opinions. Here you will find a real-time chart of the Dow Jones.

Dow Jones Key Figures ; High, 41,, 41,, 41, ; Low, 38,, 38,, 37, Dow Jones Industrial Average (DJI) ; Prev. Close: 40, ; Open: 40, ; 1-Year Change: % ; Volume: ,, ; Average Vol. (3m): ,, (DJIA / Dow 30). TOP. Bear- Market Low. All-Time High. Chart. Recent. COVID-. Today's market ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41,, (%) ; S&P INDEX, 5,, (%). Interactive Chart for Dow Jones Industrial Average (^DJI), analyze all the data with a huge range of indicators. The latest market data for all 30 stocks in the Dow Jones Industrial Average Dow 30 Chart. CNBC logo · Subscribe to CNBC PRO · Subscribe to Investing Club. Get the latest Dow Jones Industrial Average .DJI) value, historical performance, charts, and other financial information to help you make more informed. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Dow Jones Industrial Average · Price (USD)41, · Today's Change / % · Shares tradedm · 1 Year change+% · 52 week range32, - 41, Dow Jones Industrials Average ($DOWI) ; Day, 38,, +7,, +%, ,, ; Year-to-Date, 38,, +3,, +%, ,, View live Dow Jones Industrial Average Index chart to track latest price changes. TVC:DJI trade ideas, forecasts and market news are at your disposal as. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. The observations for the Dow Jones Industrial Average represent the daily index value at market close. The market typically closes at 4 PM ET, except for. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. In depth view into Dow Jones Industrial Average including performance, historical levels from , charts and stats Day Average Daily Volume. Free live Dow Jones Chart - Our popular DJIA index live chart page featuring our real time stock chart, news and quotes. The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except. Oops looks like chart could not be displayed! · Open40, · Day High41, · Day Low40, · Prev Close40, · 52 Week High41, · 52 Week High Date. Download scientific diagram | Dow Jones Industrial Average Daily Chart from publication: Booms and Busts in United States Financial Markets.

Short Sale Vs Foreclosure

You may be able to avoid foreclosure or a short sale and hold onto your property by filing for bankruptcy. In addition, you may be able to escape the stigma of. SHORT SALE, vs. FORECLOSURE. Property is sold and lender accepts proceeds as payment in full, vs. Lender takes title and forces sale of the property. In 99% of cases, short sales are better for borrowers or homeowners than foreclosures. Foreclosures can make it hard for you to get another mortgage in the. By comparison, short sales happen just prior to that point. Generally speaking, the foreclosure process begins three to six months after the first missed. A short sale is a practical alternative to foreclosures in Jacksonville. It lessens the burden of additional costs and fees for both the borrower and the. The big difference between a foreclosure, pre-forclosure and a short sale is that each one is set up based on the homeowner's situation. Who is selling the home. SHORT SALE VS. FORECLOSURE ; Homeowner's involvement, Voluntary by the homeowner but requires approval from the lender, Involuntary for the homeowner; the lender. A Short Sale is listed as SETTLED DEBT and is much less harmful to the homeowner's credit than a foreclosure. It is not Paid in Full as it would be if the full. With a short sale, the list price is meaningless, as the list price on a short sale has not been set by the party that must approve the offer – the lender. So. You may be able to avoid foreclosure or a short sale and hold onto your property by filing for bankruptcy. In addition, you may be able to escape the stigma of. SHORT SALE, vs. FORECLOSURE. Property is sold and lender accepts proceeds as payment in full, vs. Lender takes title and forces sale of the property. In 99% of cases, short sales are better for borrowers or homeowners than foreclosures. Foreclosures can make it hard for you to get another mortgage in the. By comparison, short sales happen just prior to that point. Generally speaking, the foreclosure process begins three to six months after the first missed. A short sale is a practical alternative to foreclosures in Jacksonville. It lessens the burden of additional costs and fees for both the borrower and the. The big difference between a foreclosure, pre-forclosure and a short sale is that each one is set up based on the homeowner's situation. Who is selling the home. SHORT SALE VS. FORECLOSURE ; Homeowner's involvement, Voluntary by the homeowner but requires approval from the lender, Involuntary for the homeowner; the lender. A Short Sale is listed as SETTLED DEBT and is much less harmful to the homeowner's credit than a foreclosure. It is not Paid in Full as it would be if the full. With a short sale, the list price is meaningless, as the list price on a short sale has not been set by the party that must approve the offer – the lender. So.

Short Sale vs. Foreclosure: Credit Score and Credit History · Short Sale: The effect a short sale has on your credit score depends largely on how it is reported. A short sale happens when a homeowner owes more on the mortgage balance than the market value or sale price of the property at the point the owner wants to sell. Another key difference between a foreclosure and a short sale is the timeline. Foreclosures tend to be relatively quick, while short sales can take much longer. Short Sale vs. Foreclosure. Short Sale vs. Foreclosure 1. Uncertainty on the Estate. Tax Front. 2. To File or Not to File. 3. Is Your Business Entity Excluded. Foreclosure homes are sold “as-is.” Unlike a short sale, you cannot get an inspection or appraisal before buying. There may be more damage with a foreclosed. When you decide to get out from under real estate, is a short sale vs. bankruptcy an option? Short sales avoid foreclosure. Bankruptcy in Ohio will. This is because such sales rarely attract buyers willing to pay more than a fraction of the property's true worth. If the lender buys the home itself at the. That is completely situational. · With a short sale it may take longer to get an approval from the bank and ultimately close. · With a foreclosure. By comparison, short sales happen just prior to that point. Generally speaking, the foreclosure process begins three to six months after the first missed. Short sales are common amongst distressed homeowners who exhibit a propensity not to pay their mortgage obligations. The more clear it becomes that a homeowner. Foreclosure gives a lender the right to sell property that was pledged for a debt. Credit Impact. SHORT SALE. Sellers generally expect short sales to have a. A short sale is a transaction in which the bank lets the delinquent homeowner sell the home for less than what's owed. A short sale is a transaction in which the lender, or lenders, agree to accept less than the mortgage amount owed by the current homeowner. In a "short sale," a homeowner who's behind in loan payments sells their home for an amount that's less than their outstanding mortgage debt. Most landlords view a short sale more favorable than a foreclosure when pulling a tenant's credit and determining the prospective tenant's ability to pay rent. If a short sale is needed because the proceeds will not cover a payoff then that's the next best option for your credit rating. If you have no. The process starts when a seller who is behind in his payments attempts to sell his house before the bank takes the property through foreclosure. To do this. This is because such sales rarely attract buyers willing to pay more than a fraction of the property's true worth. If the lender buys the home itself at the. Short Sale vs. Foreclosure · The primary difference between a short sale and a foreclosure is in who is selling the property. · When a bank is unable to sell. Deed in Lieu on the other hand is a deed action often used after a failed attempt for a short sale. In a deed in lieu agreement, the property is simply retitled.